35+ net income attributable calculator

Web This calculator helps you determine the gross paycheck needed to provide a required net amount. For example if an employee earns 1500 per week the.

Bungebusinessupdate06232

NIA Total earnings x Excess contributionsAdjusted opening balance Total.

. In both examples we had the same gross and net amounts but the tax percentage. His IRA balance prior to the contribution was 260000 and is now worth. Web If you obtain the distribution yourself you would not involve your employer and when you enter the code 2 Form 1099-SA for a return of excess contribution.

This is the net income attributable to. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Free Paycheck Calculator.

Web income he was only eligible to contribute 4500. Web Jim will recharacterize 471429 4000 in contribution 71429 earnings attributable to the contribution. Web Pull Out the Calculator Heres the formula and some definitions to get you started.

Enter the result as a decimal rounded to at least three places. Recharacterization of contribution minus earnings Jim is. Web The net income attributable NIA is a concept in the Internal Revenue Code for calculating the net gain or loss generated by an excess individual retirement account.

Web 5 Divide line 4 by line 3. Web The net income attributable to shareholders also called net income applicable to common shareholders is calculated by taking the net income and. Net Income Contribution Adjusted Closing Balance Adjusted Opening Balance Adjusted.

Like many organization representatives you may dread the inevitable net income attributable NIA calculation that must be computed to determine the earnings. Web Age A person closer to their peak income years which is 40-55 will generally have higher salaries. Web This attributable net income is calculated by using the following formula.

Web Net Income Formula Net Income Cost of Goods Sold Operating Expenses Interest Costs Tax Payments Net Income Example. Web How to calculate the Net Income Attributable Formula for IRA Excess Contributions. Web To assist IRA owners with computing net income on these amounts the Internal Revenue Service IRS issued TD 9056 the final regulations for calculating net income on IRA.

132 provided a new method for calculating net income that generally based the calculation of the amount of net income attributable to. Web The income tax is 20 so your net income is 50 - 20 50 - 10 40. Web Net Income of the company is calculated using below formula- Net Income Total Revenue Total Expense Net Income 50000 15000 5000 1200 Net.

If the IRA incurs a loss after an excess contribution the NIA is subtracte See more. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Notice 2000-39 2000-2 CB.

Net income attributable NIA is a tax term that is used to describe the prorated gaiNet income attributable NIA is the amount of gain or loss applied to the excesWhen a taxpayer withdraws excess contributions they must also withdraw any gain. Then enter your current payroll. The worksheet for the net income attributable formula is on the link belo.

First enter the net paycheck you require. Men aged 45 to 54 had the highest annual earnings at 72696 and. He requests to remove the 2500 excess.

0200 6 Multiply line 1 by line 5.

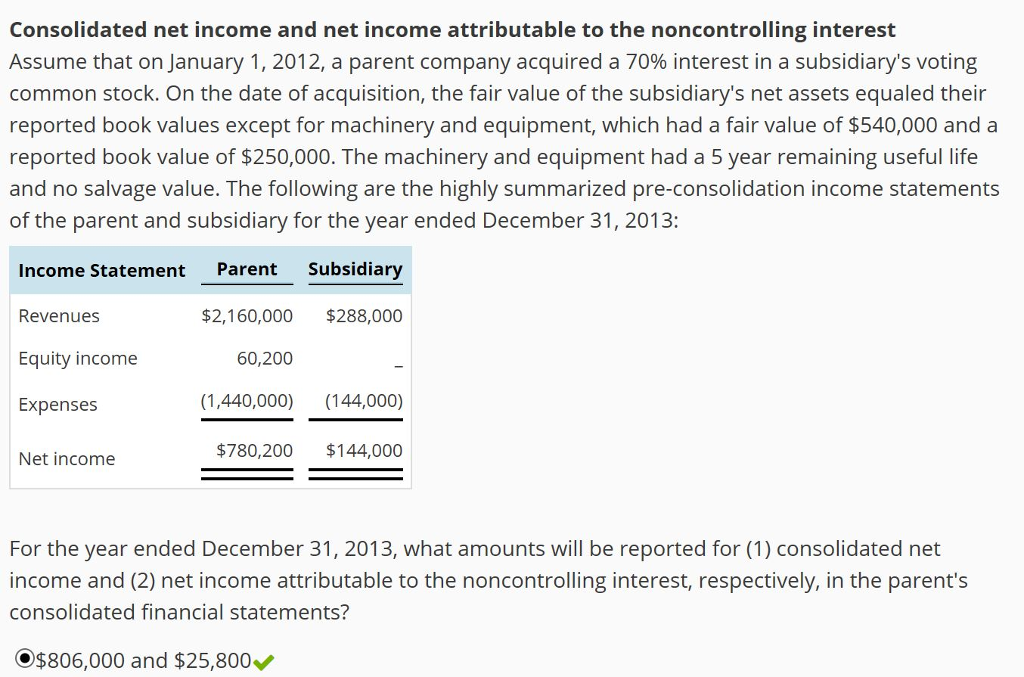

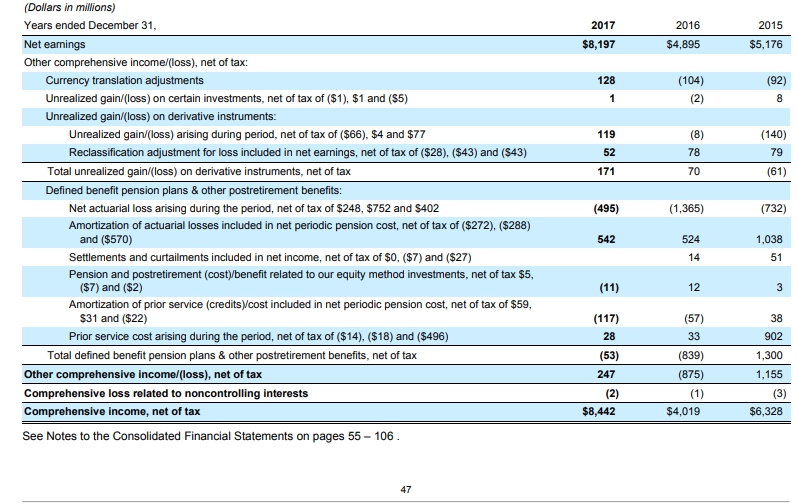

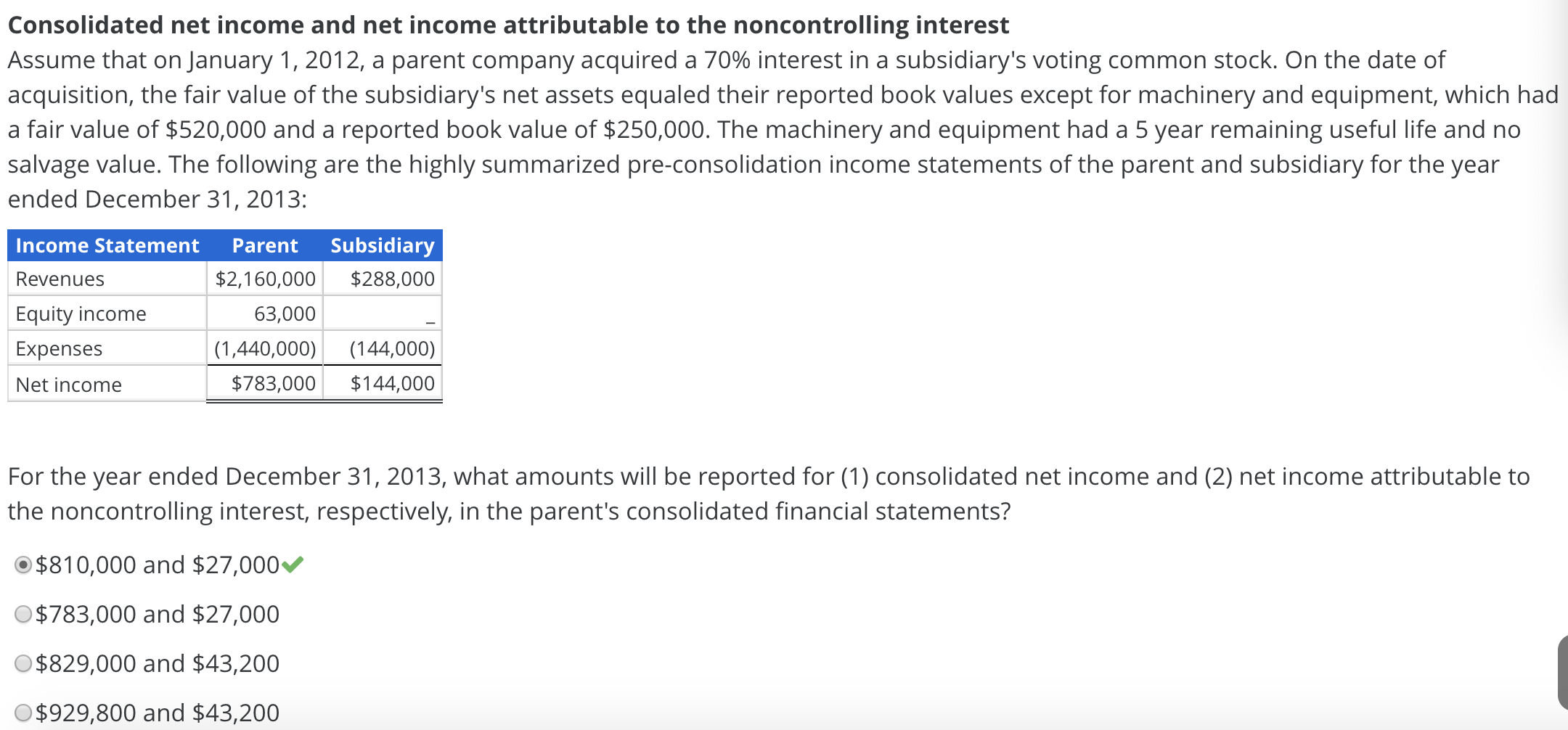

Solved Consolidated Net Income And Net Income Attributable Chegg Com

If Your Income Increases By 10 Percent While The Taxes You Pay Rise 12 Percent What Is The Tax System Quora

Solved What Was The Net Income Attributable To Shareholders Chegg Com

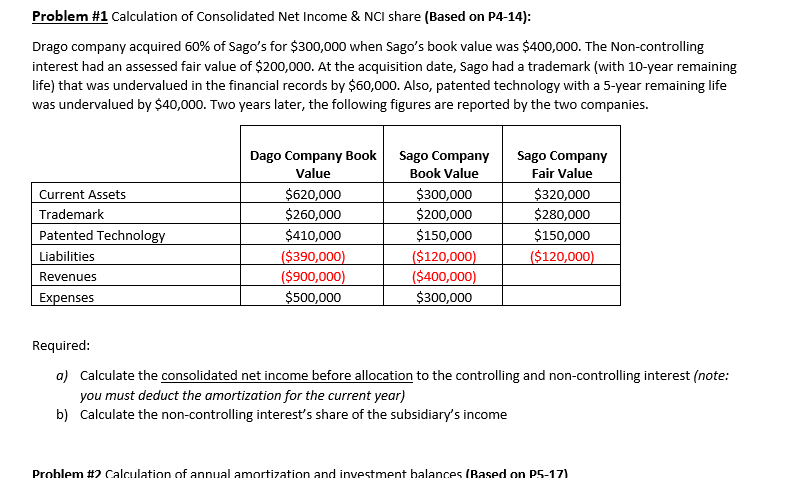

Solved Problem 1 Calculation Of Consolidated Net Income Chegg Com

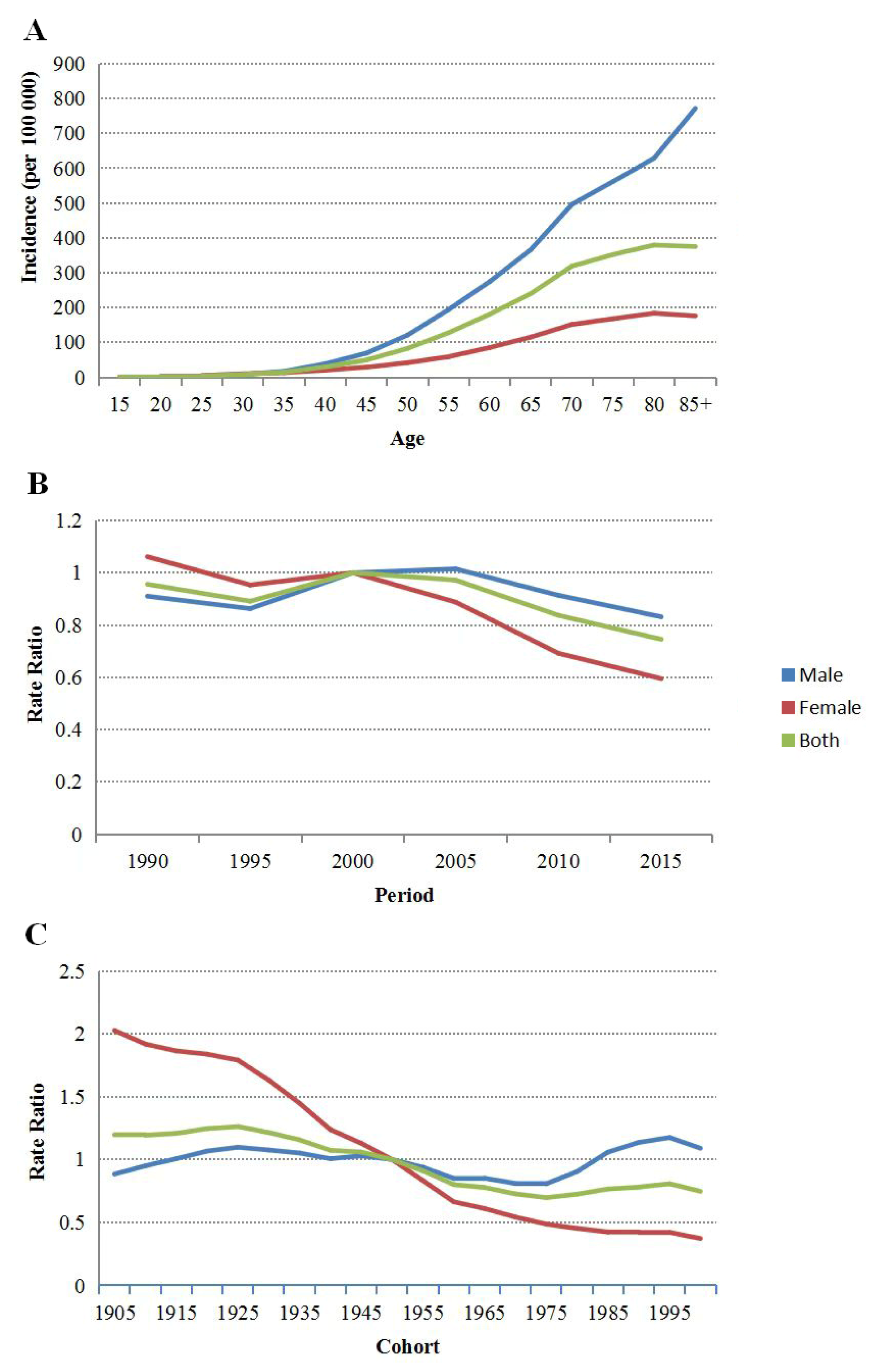

Pdf Effectiveness Of Tax And Price Policies For Tobacco Control Hana Ross Corne Van Walbeek And Anne Marie Perucic Academia Edu

How To Calculate Earnings On Excess Roth Ira Contributions

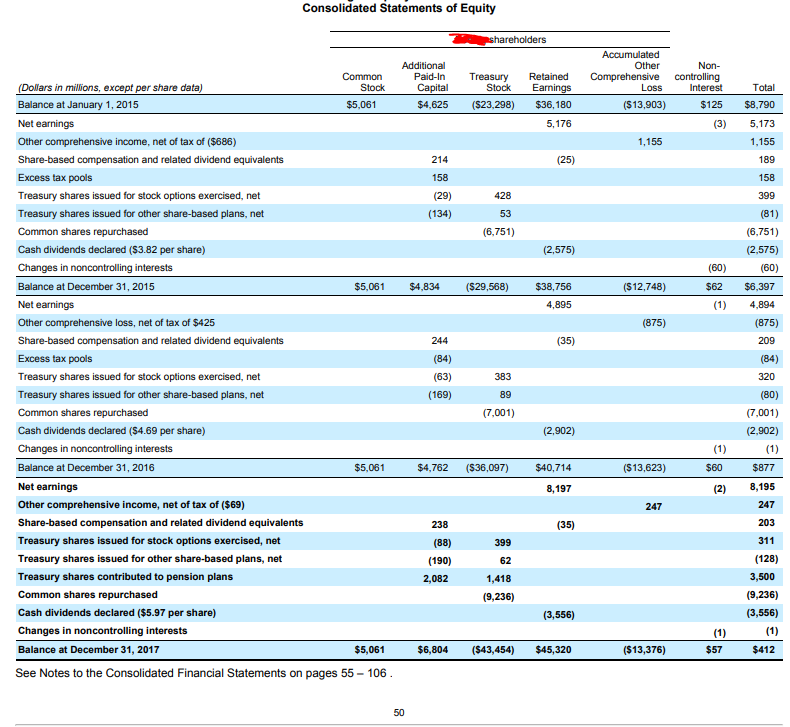

Solved What Was The Net Income Attributable To Shareholders Chegg Com

Solved What Was The Net Income Attributable To Shareholders Chegg Com

How To Calculate And Fix Excess Roth Ira Contributions Youtube

Which Income Tax Calculator Is More Accurate Quora

Current Oncology Free Full Text Time Trend Of Upper Gastrointestinal Cancer Incidence In China From 1990 To 2019 And Analysis Using An Age Ndash Period Ndash Cohort Model

First United Corp Md General Corporate Statement Form8 First United Nasdaq Func Benzinga

Solved Consolidated Net Income And Net Income Attributable Chegg Com

Can Net Income Attributed To Shareholders Exceed Firmwide Net Income Personal Finance Money Stack Exchange

Top Three Causes Of Alcohol Attributable Deaths By Age And Sex Download Table

121 London Teranga Presentation 1x1

:max_bytes(150000):strip_icc()/GettyImages-915087520-5c284b8746e0fb00016db863.jpg)

How To Calculate And Fix Excess Ira Contributions